Parents all around the world want to protect their kids from harm and provide them with a stable future and security, and it is still important to have life insurance for your children. It is safe to say that we should be prepared for all circumstances in life, this article is for Parents from Canada. We present a guide to you for the best life insurance for your children.

What Is Life Insurance for Kids?

Life insurance for kids is defined as an insurance that covers the cost of a child’s life. The insurance can have various values depending on the type you choose and it can even build cash value over time. Life insurance for children isn’t for their death, it’s like planting a tree and watching it grow over time.

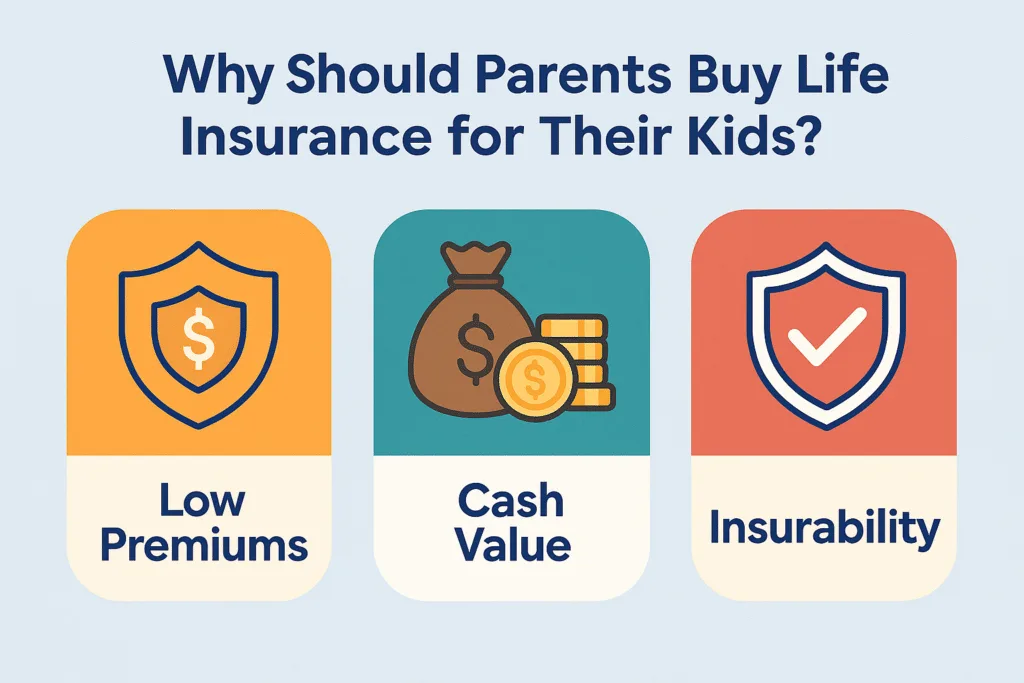

Why Should Parents Buy Life Insurance for Their Kids?

There are various reasons that parents should purchase life insurance for their children:

- To lock in low premiums early:

Life insurance premium is the payment that is made towards the insurance to keep it running. When a person is younger and healthier the lower their life insurance premium will be. When a life insurance policy is purchased for a child, the low premium payments are locked in for the child’s life (depending on the policy you choose).

- Cash value savings component:

A portion of your premium payments can go towards a tax-advantaged saving account, which is known as the cash value. The cash value benefit for your child is that they can access these funds to aid in their events like, education or business ideas.

- Guaranteed Insurability for the Future

This guaranteed insurability for the future is considered as a significant benefit of child insurance. This policy allows children to convert their coverage to a permanent policy when they reach the age of 25. The early purchase of a child’s insurance will also protect them against higher premium payments as they get older, even if they are facing health issues like diabetes, asthma, etc.

Pros and Cons of Life Insurance for Kids

| Pros | Cons |

| Locked in, low premium rates | Opportunity cost to invest in other plans like RESP |

| Cash value growth that can be very beneficial for the child’s future (like their education) | Limited benefits in the unfortunate case of a child passing away |

| Guaranteed coverage for the child’s life | Policies and laws can be complex to understand |

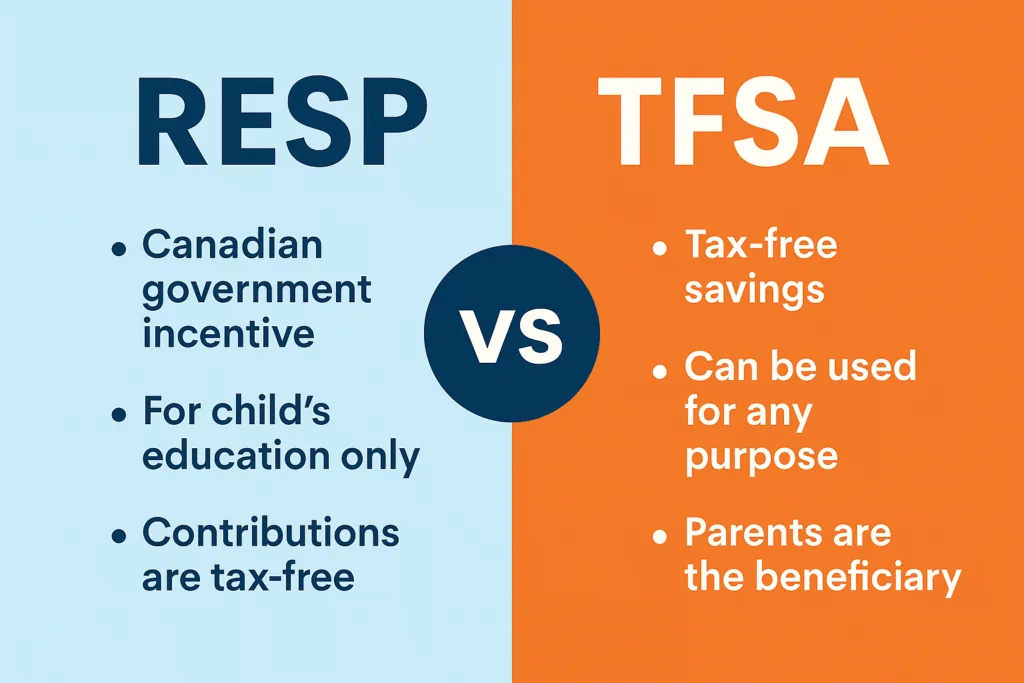

Other Savings Options in Canada

- RESP, stands for Registered Education Savings Plan:

This is a saving option for post secondary education for children which is a government incentive. Tax is deferred in this plan and the contributions are tax free, but this plan is restricted and can only be used towards the education of a child. There are also penalties for not using this fund towards a child’s education which makes the RESP less flexible than the TSFA.

- TFSA, stands for Tax-Free Savings Account for Parents:

This plan is very flexible in what it can be used towards and it is tax-free. The parents are also the beneficiary of this plan while the child can use the amount as well.

How Much Does Child Life Insurance Cost in Canada?

Life insurance in Canada can have varying costs, depending on:

- The insurance company

- The package you choose

- How long the benefit for the policy is

- Range of premiums

- Age of child

Best Life Insurance Companies for Kids in Canada

Here are 3 life insurance companies for kids, in Canada:

- SunLife Canada: Offers Child Term Benefit (CBT)

- Coverage amount: 10,000-30,000 CAD

- Coverage Duration : till the age of 25

- Benefits: Sunlife is a reputable company and they offer online applications as well.

- Coverage amount: begins at 5,000 CAD

- Coverage Duration: till the age of 26

- Benefits: This is the oldest life insurance company in Canada and allows online applications to be filled.

- Foresters: Offers Child Term Rider (CTR)

- Coverage amount: 10,000 CAD

- Coverage Duration: till the age of 25

- Benefits: The policy can be updated and have more value when the child gets older.

Questions Parents Should Ask

Here is a list of questions parents should ask themselves and their insurance company before purchasing life insurance for their child:

- Is the insurance policy for savings, insurance, or both?

- How much is the premium?

- What do I want out of this insurance plan?

Tips for Parents

Here are a few tips for parents when they are purchasing life insurance plans for the children:

- Compare and contrast multiple policy quotes, you don’t want to regret missing the golden plan

- Read policies carefully and in detail, do not miss anything or skim through the paperwork

- Research the company and insurer of your plan, to make sure they are authentic and can be trusted in the long run

Conclusion

If you’re still doubting, is life insurance for your children really worth it? Then you should think about your family goals and the peace of mind an insurance for your child’s future offers to you. Parents remember to extensively research and compare different insurance policies and choose the ones that seem suitable to your lifestyle.

Frequently Asked Questions

Why should I get my child life insurance?

You should get your child life insurance as:

- It allows the benefits of locking low premiums

- It allows the access of cash value saving component

- It guarantees insurability

Do children really require life insurance?

Children do not need life insurance, but it protects families from paying off lost debts. Life insurance can also allow your child to have access to a fund when they get older and it won’t heavily hurt your pocket if you lock in low premiums.

What does RESP stand for?

RESP is a Canadian government-registered investment plan which stands for Registered Education Savings Plan.